They thought the crypto bubble would last longer than it did and acted like the covid bubble would last forever. It'll take at least three more years for things to settle to post-covid, post-crypto normal.Both companies are in big trouble IMHO.

News Intel Posts Largest Loss in Its History as Sales Plunge 36%

Page 2 - Seeking answers? Join the Tom's Hardware community: where nearly two million members share solutions and discuss the latest tech.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TerryLaze

Titan

Yup you can even use an ARM device but you will have to use something.That's nice, but here's another little secret for you: I don't have to buy Intel either.

Right now, I'm using a Ryzen 9 processor, an AMD x670E chipset on the motherboard, a Corsair SSD, and an Nvidia GPU. My current machine is 0% Intel which is amazing.

I take that back, there is one Intel device on this machine. It's the @*&^$& wifi card that keeps cutting out on me, forcing me to constantly reboot the computer! 🤣

AMD even if they buy up TSMC completely can not produce enough stuff to make intel go out of business completely.

And Intel is going into GPU now and works with ARM on the next gen ARM devices...

So they lost 200M more than they expected nothing to see here get back to work.

caknowledge.com

caknowledge.com

Intel Net Worth 2024: Assets Income Revenue PE Ratio CEO

Intel Net Worth, History, Assets, Income, Liabilities, Net Income and many more details can be checked from this page. Intel's net worth is around $153 billion.

D

Deleted member 2838871

Guest

That's nice, but here's another little secret for you: I don't have to buy Intel either.

Right now, I'm using a Ryzen 9 processor, an AMD x670E chipset on the motherboard, a Corsair SSD, and an Nvidia GPU. My current machine is 0% Intel which is amazing.

Hahah.. same here. Just built my first AMD system since the Athlon XP 1800+ in 2001. Other than the cpu and mobo blowing up last weekend it's been amazing... and my RMA was approved so I'm not out anything.

For me though... it's all about getting the best hardware... I don't care who makes it. I've been with Intel for 20 years... and my 2017 build was Intel because Ryzen was new and unproven.

This 2023 build was because AM5 is new (and unproven I know) but I preferred having the ease of upgrading option (and better thermals) vs going with Intel 13th gen/LGA 1700 that is already EOL.

Intel didn't get my money this time... but the company will be fine.

Intel presented a bunch of good news on their EUV processing. Intel-3 Granite Rapids and Sierra Forest are sampling in high volumes. Intel-4 Meteor Lake is entering production for a 2H launch. Lunar Lake taped-in back in January for Intel-18A. They had a successful test of Power Via, which they claim led to the ARM collaboration announcement.

It's looking like IFS is going to be cranking out leading edge chips for Intel and anyone else who might prefer to build here in the U.S., so the growth possibilities are huge.

The new server platform will include a third chip, Clearwater Forest, on Intel-18A.

There was also positive news on the Gaudi 2 performance, and the announcement that they had taped in Gaudi 3. That's looking like it could become a new growth business, as well.

There was also an announcement about their PSG group having 15 new parts coming this year, following a couple of years of positive announcements about their Agilex FPGAs and new IPUs.

It's looking like IFS is going to be cranking out leading edge chips for Intel and anyone else who might prefer to build here in the U.S., so the growth possibilities are huge.

The new server platform will include a third chip, Clearwater Forest, on Intel-18A.

There was also positive news on the Gaudi 2 performance, and the announcement that they had taped in Gaudi 3. That's looking like it could become a new growth business, as well.

There was also an announcement about their PSG group having 15 new parts coming this year, following a couple of years of positive announcements about their Agilex FPGAs and new IPUs.

irish_adam

Distinguished

They don't release their earnings until next week so I have no idea what you are looking at but most analyst expect them to be around guidance and while revenue and profits have dropped YoY they have not dropped by 80% and what far more important, AMD still made money. So yeah I am not sure what world you live in but in the real world, AMD's financials are looking a hell of a lot better than Intel's at the moment.Just for fun, I looked up AMD's 2023 Q1 P&L, and they are not in much better shape than Intel. Profits dived like over 80%.

Both companies are in big trouble IMHO.

Not that I think Intel will go under but they are massively bloated right now and need to drastically reduce spending. They keep talking about TAM but the reality is that they don't have competitive products right now in most of their high margin segments, even if the industry was growing they would be losing money. They need to make some hard decisions, AMD seem to be here to stay so spending as usual and hoping the market will recover and they'll go back monopolising x86 before they run out of cash is beyond stupid.

sitehostplus

Distinguished

Investopedia is estimating that drop.They don't release their earnings until next week so I have no idea what you are looking at but most analyst expect them to be around guidance and while revenue and profits have dropped YoY they have not dropped by 80% and what far more important, AMD still made money. So yeah I am not sure what world you live in but in the real world, AMD's financials are looking a hell of a lot better than Intel's at the moment.

Not that I think Intel will go under but they are massively bloated right now and need to drastically reduce spending. They keep talking about TAM but the reality is that they don't have competitive products right now in most of their high margin segments, even if the industry was growing they would be losing money. They need to make some hard decisions, AMD seem to be here to stay so spending as usual and hoping the market will recover and they'll go back monopolising x86 before they run out of cash is beyond stupid.

At least AMD is still profitable, though it's not by much.

Kamen Rider Blade

Distinguished

You better pray that nobody pops their balloon.They had a super high for the last 6 years and are now basically twice the company they were then.

From last quarter of 2016 to today:

property went from 36 to 85

total assets from 113 to 185

now the total bebt also increased by a lot but in general it's like if the titanic blew up like a balloon and lifted to the sky, then what intel goes through would be just like it.

They don't have a infinite amount of Cash Reserves.

twist it all around as much as you want, the FACT is, intel has lost money for 3 quarters, for intel, and its size, its NOT a good thing, regardless what you come up with. if intel was still doing as well as you claim them to be, they wouldnt of lost money for yet another quarter.They had a super high for the last 6 years and are now basically twice the company they were then.

From last quarter of 2016 to today:

property went from 36 to 85

total assets from 113 to 185

now the total bebt also increased by a lot but in general it's like if the titanic blew up like a balloon and lifted to the sky, then what intel goes through would be just like it.

sorry Jay but announcements and " its looking like " wording is all smoke and mirrors. until intel actually comes through on any of that, its just words to keep investors happyIntel presented a bunch of good news on their EUV processing. Intel-3 Granite Rapids and Sierra Forest are sampling in high volumes. Intel-4 Meteor Lake is entering production for a 2H launch. Lunar Lake taped-in back in January for Intel-18A. They had a successful test of Power Via, which they claim led to the ARM collaboration announcement.

It's looking like IFS is going to be cranking out leading edge chips for Intel and anyone else who might prefer to build here in the U.S., so the growth possibilities are huge.

The new server platform will include a third chip, Clearwater Forest, on Intel-18A.

There was also positive news on the Gaudi 2 performance, and the announcement that they had taped in Gaudi 3. That's looking like it could become a new growth business, as well.

There was also an announcement about their PSG group having 15 new parts coming this year, following a couple of years of positive announcements about their Agilex FPGAs and new IPUs.

sitehostplus

Distinguished

No, I am just telling you I have a choice. So it might be wise of Intel to at least do something to earn my dollars, don't you think?Yup you can even use an ARM device but you will have to use something.

AMD even if they buy up TSMC completely can not produce enough stuff to make intel go out of business completely.

And Intel is going into GPU now and works with ARM on the next gen ARM devices...

It's not that Intel puts out bad processors but having an attitude that 'he's going to have to spend that money sometime' and treating me like I'm a criminal for wanting good value for my money is a great way to get punted to the curb.

A&P had that attitude. Where did it get them? Bankrupt and gone in 2015.

Sears had that attitude. Where are they now? Only two actual stores left last time I checked.

Both of those were companies the size of Intel. Both are either gone or pretty much gone.

That is where that attitude will get you, and it doesn't matter if you have billions upon billions to burn or are just a mom-and-pop shop. Nobody is too big to fail.

Huge chunks of governments around the world relies on Intel stuff. Governments won't allow Intel to fail since it would screw them up too. They will bail Intel out of bankruptcy one way or another if it ever gets that bad.That is where that attitude will get you, and it doesn't matter if you have billions upon billions to burn or are just a mom-and-pop shop. Nobody is too big to fail.

and we as tax payers should tell our governments, to go get stuffed if they want to bail intel out. instead, spend that money on more important things, like health care, housing and schoolsGovernments won't allow Intel to fail since it would screw them up too. They will bail Intel out of bankruptcy one way or another if it ever gets that bad.

There won't be "important things like health, housing and schools" without infrastructure to keep the government running.and we as tax payers should tell our governments, to go get stuffed if they want to bail intel out. instead, spend that money on more important things, like health care, housing and schools

Imagine the fun China would have if it bought Intel out of bankruptcy. China gaining access to chipset, CPU, IGP, GPU, etc. micro-code would threaten the national security of every country on the planet.

there is others then just intel for that.There won't be "important things like health, housing and schools" without infrastructure to keep the government running.

Great. I hope they end up begging AMD for mercy at some point.

If AMD didn’t do a come back with their ryzen series, we would still be paying $1000 for 8 cores Cpus at best.

I think it means that it’s the end of x86, this rotten tech need to disappear now… not only it’s technically horrible, but it lock competition between only 2 or 3 companies.

If AMD didn’t do a come back with their ryzen series, we would still be paying $1000 for 8 cores Cpus at best.

I think it means that it’s the end of x86, this rotten tech need to disappear now… not only it’s technically horrible, but it lock competition between only 2 or 3 companies.

that would be intel that locks x86 between them and amd ( i think via can still make X86 compatible cpus, but they havent made anything worth while in quite some time ) intel " could " give licenses to others to make x86 cpus, but they choose not tobut it lock competition between only 2 or 3 companies.

TerryLaze

Titan

No, it's not infinite, but it is very large.You better pray that nobody pops their balloon.

They don't have a infinite amount of Cash Reserves.

Intel Retained Earnings (Accumulated Deficit) 2010-2025 | INTC

Intel retained earnings (accumulated deficit) from 2010 to 2025. Retained earnings (accumulated deficit) can be defined as profits reinvested in the corporation after dividends have been paid out. <ul style='margin-top:10px;'> <li>Intel retained earnings (accumulated deficit)...

| Intel Annual Retained Earnings (Accumulated Deficit) (Millions of US $) | |

|---|---|

| 2022 | $70,405 |

| 2021 | $68,265 |

| 2020 | $56,233 |

| 2019 | $53,523 |

| 2018 | $50,172 |

| 2017 | $42,083 |

| 2016 | $40,747 |

| 2015 | $37,614 |

| 2014 | $33,418 |

| 2013 | $35,477 |

| 2012 | $32,138 |

| 2011 | $29,656 |

| 2010 | $32,919 |

Yes my local brick and mortar intel corner store is shacking in their boots...oh wait, they are a completely different type of company, one that doesn't get killed by online stores being much cheaper and more convenient.No, I am just telling you I have a choice. So it might be wise of Intel to at least do something to earn my dollars, don't you think?

It's not that Intel puts out bad processors but having an attitude that 'he's going to have to spend that money sometime' and treating me like I'm a criminal for wanting good value for my money is a great way to get punted to the curb.

A&P had that attitude. Where did it get them? Bankrupt and gone in 2015.

Sears had that attitude. Where are they now? Only two actual stores left last time I checked.

Both of those were companies the size of Intel. Both are either gone or pretty much gone.

That is where that attitude will get you, and it doesn't matter if you have billions upon billions to burn or are just a mom-and-pop shop. Nobody is too big to fail.

Also intel is making the CPUs that people need, they aren't trying to upsell you on a server CPU.

"It's not that Intel puts out bad processors but having an attitude that 'he's going to have to spend that money sometime' and treating me like I'm a criminal for wanting good value for my money is a great way to get punted to the curb."

Nobody is threatening anybody, or treating you like a criminal.

But the response to "they have to reduce prices every time the market goes soft" is still that people have to update sometime (let alone all the new people and new companies) so you just have to wait it out.

TerryLaze

Titan

AMD Retained Earnings (Accumulated Deficit) 2010-2025 | AMD

AMD retained earnings (accumulated deficit) from 2010 to 2025. Retained earnings (accumulated deficit) can be defined as profits reinvested in the corporation after dividends have been paid out. <ul style='margin-top:10px;'> <li>AMD retained earnings (accumulated deficit) for...

| AMD Annual Retained Earnings (Accumulated Deficit) (Millions of US $) | |

|---|---|

| 2022 | $-131 |

| 2021 | $-1,451 |

| 2020 | $-4,605 |

| 2019 | $-7,095 |

| 2018 | $-7,436 |

| 2017 | $-7,775 |

| 2016 | $-7,803 |

| 2015 | $-7,306 |

| 2014 | $-6,646 |

| 2013 | $-6,243 |

| 2012 | $-6,160 |

| 2011 | $-4,977 |

| 2010 | $-5,468 |

Can you or @jkflipflop98 shed any light onto what Intel means by "tape-in"? I'm seeing this phrase a lot more, lately, and I don't know if there's even a standard definition.Lunar Lake taped-in back in January for Intel-18A.

FWIW, my general understanding of "tape-out" is when the design phase of a chip is complete and the design is sent out to manufacturing, for production the first engineering samples.

If Habana doesn't start getting market traction now, I fear they never will. Or, at least that's what I'll bet some at Intel are thinking. It would be like almost nobody buying your GPUs, during the crypto boom.There was also positive news on the Gaudi 2 performance, and the announcement that they had taped in Gaudi 3. That's looking like it could become a new growth business, as well.

We've seen that movie many times. Lots of companies like DEC, SGI, Cray, etc. were essentially bought for their lucrative service contracts. Service & supply contracts represent a stable revenue stream, and someone will surely pick them up. There's no risk of Intel just completely failing and leaving customers stranded, like Lehman Bros.Huge chunks of governments around the world relies on Intel stuff. Governments won't allow Intel to fail since it would screw them up too. They will bail Intel out of bankruptcy one way or another if it ever gets that bad.

The biggest risk is that Intel can no longer invest in developing new products that compete purely on their merits. I'm not saying that will happen, but that's sort of the worst-case scenario we would see. As for IFS, they could follow Global Foundries' path and cancel nodes that aren't yet in full production. Then, just continue to milk the nodes they currently have, for as long as they're still viable.

AMD has done a fantastic job of digging themselves out of that hole. I'll bet few people thought they could do it. It's exciting to seem them finally poised to be rid of that weight from around their neck.AMD Retained Earnings (Accumulated Deficit) 2010-2025 | AMD

AMD retained earnings (accumulated deficit) from 2010 to 2025. Retained earnings (accumulated deficit) can be defined as profits reinvested in the corporation after dividends have been paid out. <ul style='margin-top:10px;'> <li>AMD retained earnings (accumulated deficit) for...www.macrotrends.net

AMD Annual Retained Earnings (Accumulated Deficit)

(Millions of US $)2022 $-131 2021 $-1,451 2020 $-4,605 2019 $-7,095 2018 $-7,436 2017 $-7,775 2016 $-7,803 2015 $-7,306 2014 $-6,646 2013 $-6,243 2012 $-6,160 2011 $-4,977 2010 $-5,468

Given the lead time involved in bringing new products to market, the things we're seeing today were started when AMD was still getting back on its feet. I can't wait to see what they've gotten up to, just these past couple years.

TerryLaze

Titan

Doesn't Xe and their iGPUs use that?! Would be kind of stupid if they use a different AI for them.If Habana doesn't start getting market traction now, I fear they never will. Or, at least that's what I'll bet some at Intel are thinking. It would be like almost nobody buying your GPUs, during the crypto boom.

Yes, they have done great, but the market is down for everybody and AMD doesn't have much in the way of backup cash to survive for long if the market doesn't recover soon.AMD has done a fantastic job of digging themselves out of that hole. I'll bet few people thought they could do it. It's exciting to seem them finally poised to be rid of that weight from around their neck.

Given the lead time involved in bringing new products to market, the things we're seeing today were started when AMD was still getting back on its feet. I can't wait to see what they've gotten up to, just these past couple years.

Now they have the whole 'CPUs blow up' fiasco on their hands...that can't be good for sales either.

AMD is a company where it would make sense to reduce prices to make some cash to tide you over the dry patch (irony noted) but intel doesn't need to, they could if they wanted to make their reports look a bit better but it would be bad for them in the longer run because people expect the lower prices to remain.

No. For the amount that you post about Intel, I'd expect you to know their products a bit better. Looks like you've got some reading to do.Doesn't Xe and their iGPUs use that?! Would be kind of stupid if they use a different AI for them.

As of their latest quarterly report, they have $5.6B in cash and short-term assets. Their latest operating expense was $3.4B, so they have enough to last them about 5 months of zero revenue. So, they're completely fine. And if those reserves started to run low, they could cut expenses (which they haven't even done so far!) and start issuing some bonds.AMD doesn't have much in the way of backup cash to survive for long if the market doesn't recover soon.

Again, you really seem to misunderstand what Retained Earnings means. It's a way of accounting for cumulative profits & losses, not the amount of money in the bank.

That's clearly not a common problem, given how long it's taken to come to light. I think it won't be a big financial liability, assuming newer BIOS is able to prevent it.Now they have the whole 'CPUs blow up' fiasco on their hands...that can't be good for sales either.

TerryLaze

Titan

I post a lot about GPUs and AI?! That's news even to me.No. For the amount that you post about Intel, I'd expect you to know their products a bit better. Looks like you've got some reading to do.

What numbers are you even looking at?!As of their latest quarterly report, they have $5.6B in cash and short-term assets. Their latest operating expense was $3.4B,

Q4 2022 amd had

| Operating expenses ($M) | $2,557 |

| Cash and cash equivalents | $ | 4,835 | ||||||

| Short-term investments | 1,020 |

Show the calculations you used, if after 5 months they are left with nothing because you used all of their assets in this (as in the sold everything) then that's not really feasible.so they have enough to last them about 5 months of zero revenue. So, they're completely fine. And if those reserves started to run low, they could cut expenses (which they haven't even done so far!) and start issuing some bonds.

On the two ccd cpus this gen they used one less good ccd with one better ccd, and this blowing up debacle could come from using inferior components or from them just waving through CPUs that should not have passed quality control.And if those reserves started to run low, they could cut expenses (which they haven't even done so far!) and start issuing some bonds.

If those aren't cost cutting decisions then they are the worst business decisions anybody has ever made.

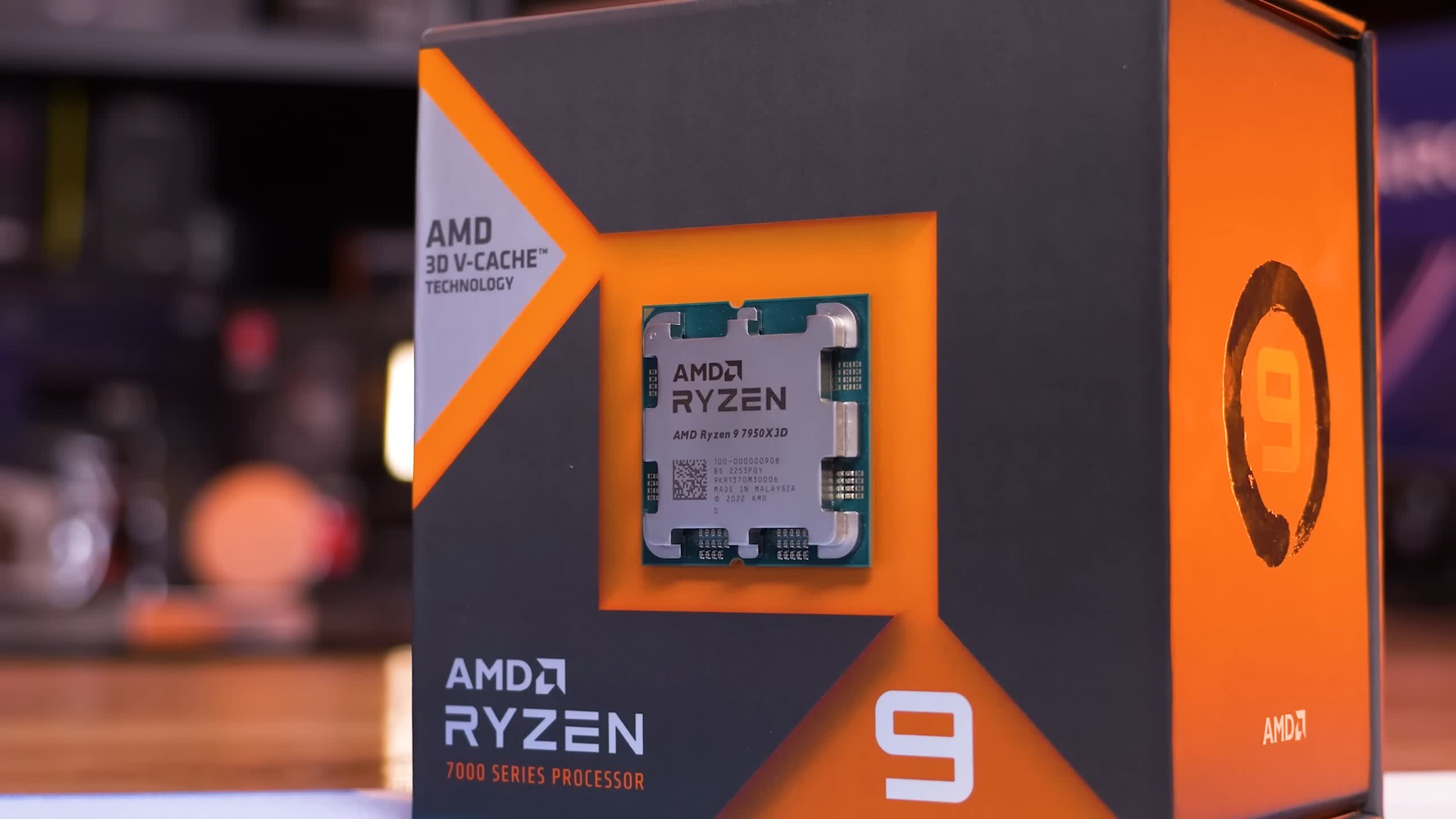

AMD Ryzen 9 7950X3D Review: Gamers, Don't Buy This One!

With extra L3 cache and lowered clocks for less heat, AMD is trying to make the Ryzen 9 7950X3D the best CPU for all scenarios. But how...

www.techspot.com

www.techspot.com

I'm not interpreting anything at all.Again, you really seem to misunderstand what Retained Earnings means. It's a way of accounting for cumulative profits & losses, not the amount of money in the bank.

"Retained earnings (accumulated deficit) can be defined as profits reinvested in the corporation after dividends have been paid out."

Obviously if you don't reinvest it you have it left over.

Interesting distinction. I guess that's a different business unit from CPUs. I tend to think of Intel PR as monolithic, but I guess each business unit at least has its own budget.I post a lot about GPUs and AI?! That's news even to me.

It was purely hypothetical, but why wouldn't it be feasible to spend your cash and liquidate all of your short-term investments? Obviously, a company needs some amount of working capital to operate, but then revenues wouldn't ever go all the way to zero, either. As I said, it was hypothetical.if after 5 months they are left with nothing because you used all of their assets in this (as in the sold everything) then that's not really feasible.

The main point was they have a cushion that should be more than adequate.

I was referring to layoffs.If those aren't cost cutting decisions

Last edited:

TRENDING THREADS

-

-

-

-

Question Can my PC handle a NVIDA 3060 TI without upgrading anything else?

- Started by hexzero13

- Replies: 22

-

News Introducing the Tom’s Hardware Premium Beta: Exclusive content for members

- Started by Admin

- Replies: 43

-

-

Space.com is part of Future plc, an international media group and leading digital publisher. Visit our corporate site.

© Future Publishing Limited Quay House, The Ambury, Bath BA1 1UA. All rights reserved. England and Wales company registration number 2008885.