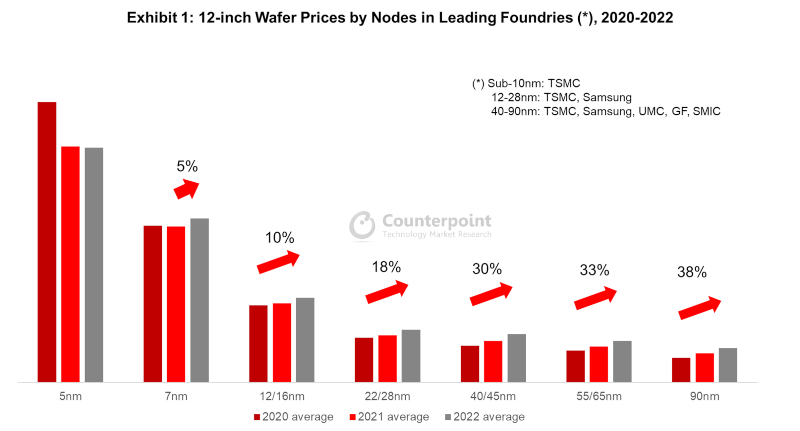

TSMC has been aggressively raising prices on high-end nodes in the last 3 years. Far higher than inflationary pressure can possibly explain.

The reason these price hikes are so extremely aggressive on high-end nodes but less on low-end, is a reflection of TSMC competition on low-end nodes, but monopoly on high-end nodes

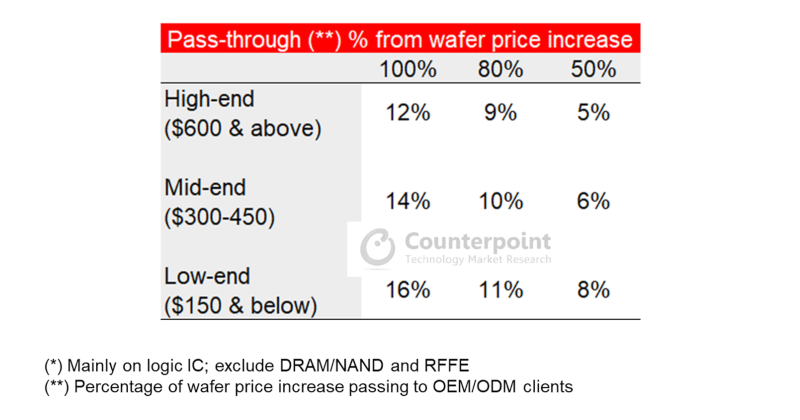

Increased price of wafer has a large impact on the subsequent price of hardware products.

By 2022, Apple (TSMC's biggest customer) actually rejected TSMC price hikes. But because TSMC has such a monopoly on high-end nodes, even Apple was forced to bend the knee for TSMC.

All these hardware companies like Apple, Nvidia, etc...would love nothing more than TSMC getting some competition.

795×264 jpg

39,1 kB